Why MHub?

Why MHub?

Buying a property can be a very rewarding experience. But it can also be a very tedious one with the many processes involved. A typical sales cycle can take up to 3 months and sometimes more.

This is because there are many stakeholders involved in a property transaction.

MHub serves as an end-to-end platform for property transactions cycle linking all the stakeholders so that collaboration and deals can happen quicker and more efficiently.

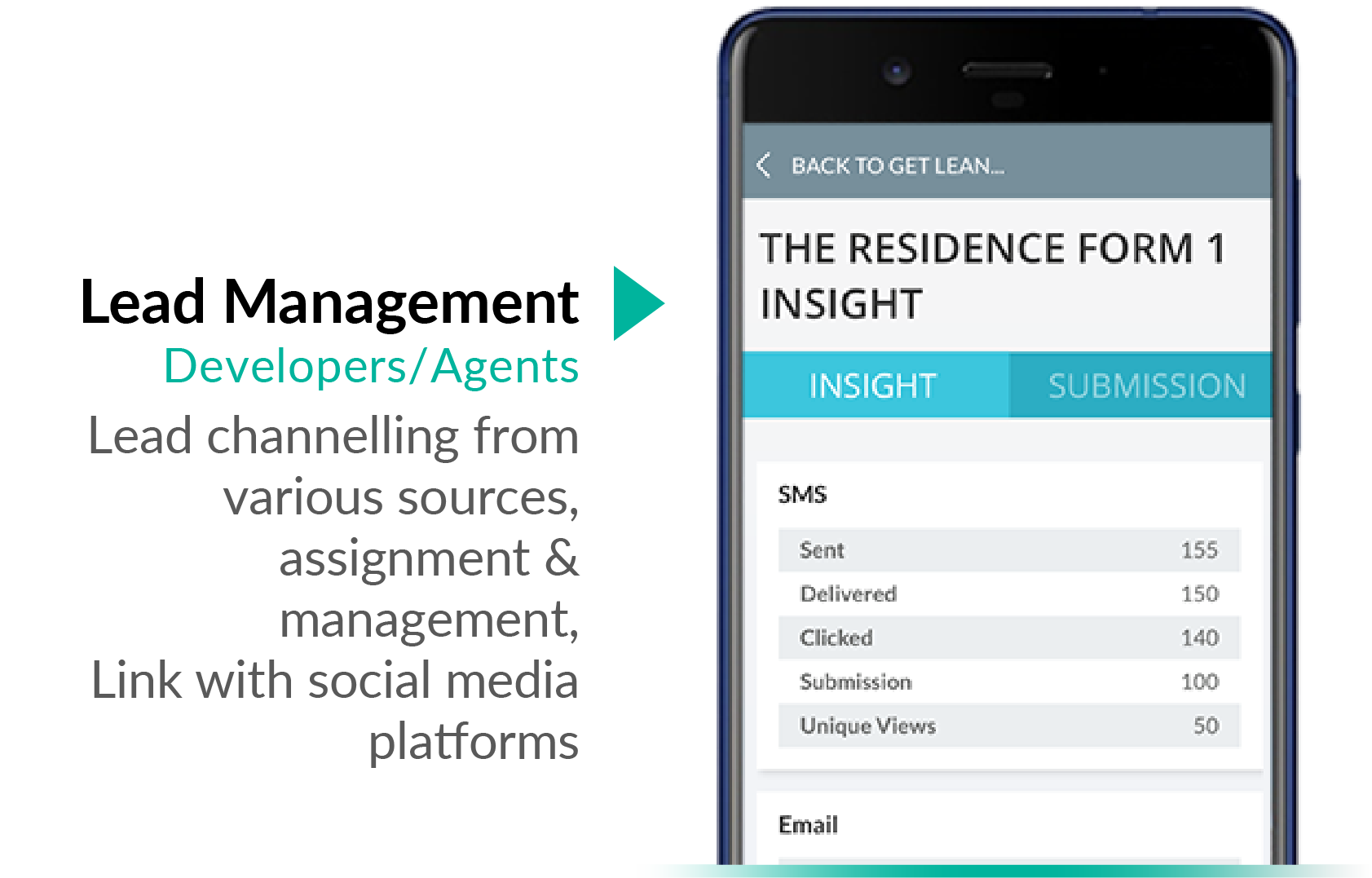

Leads obtained offline/online are not tracked properly resulting in dropouts or delayed engagement.

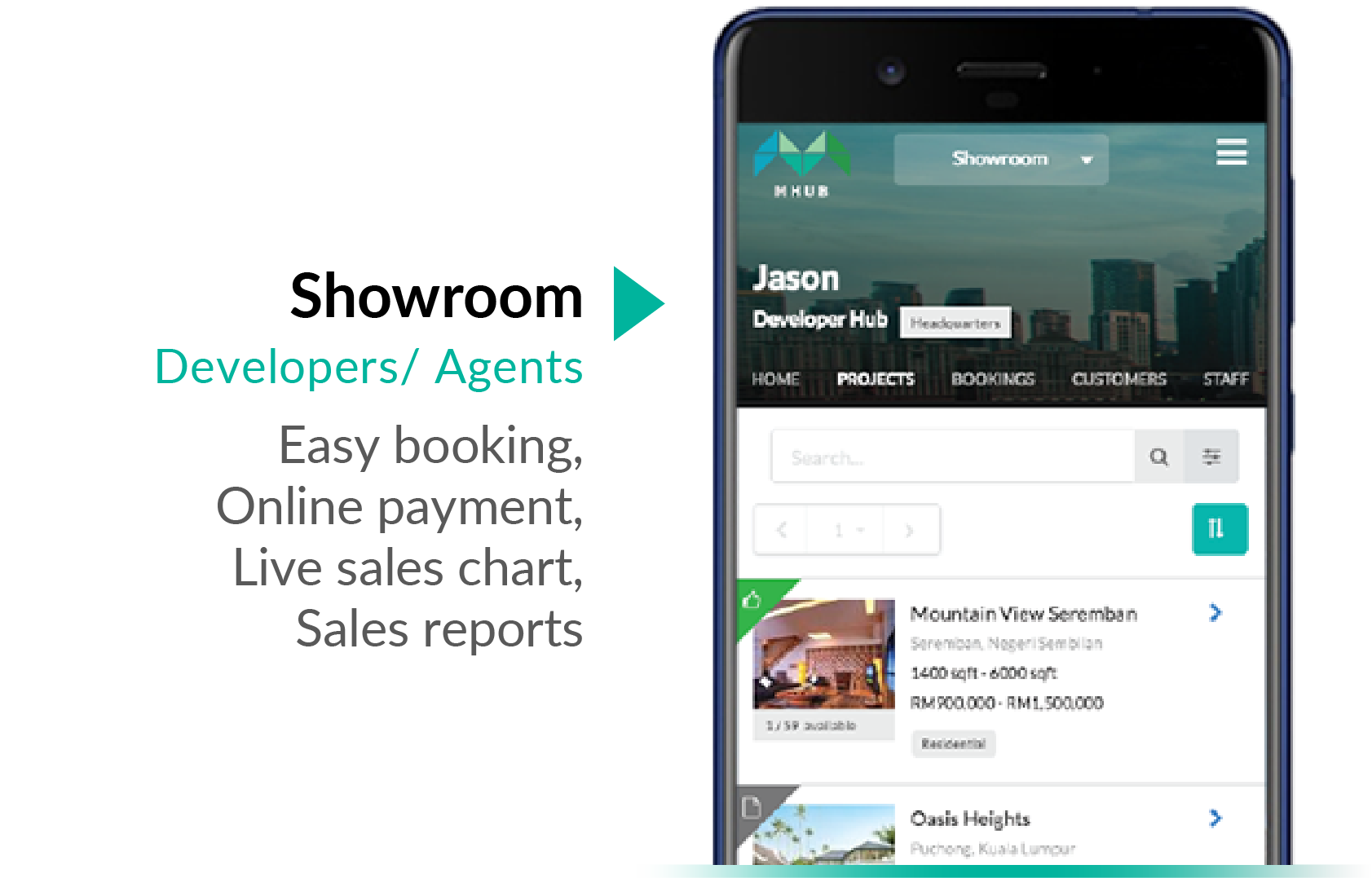

Unless sales teams are physically at the show galleries, they won’t readily know the unit availability / price structure – this can cause double bookings and delays.

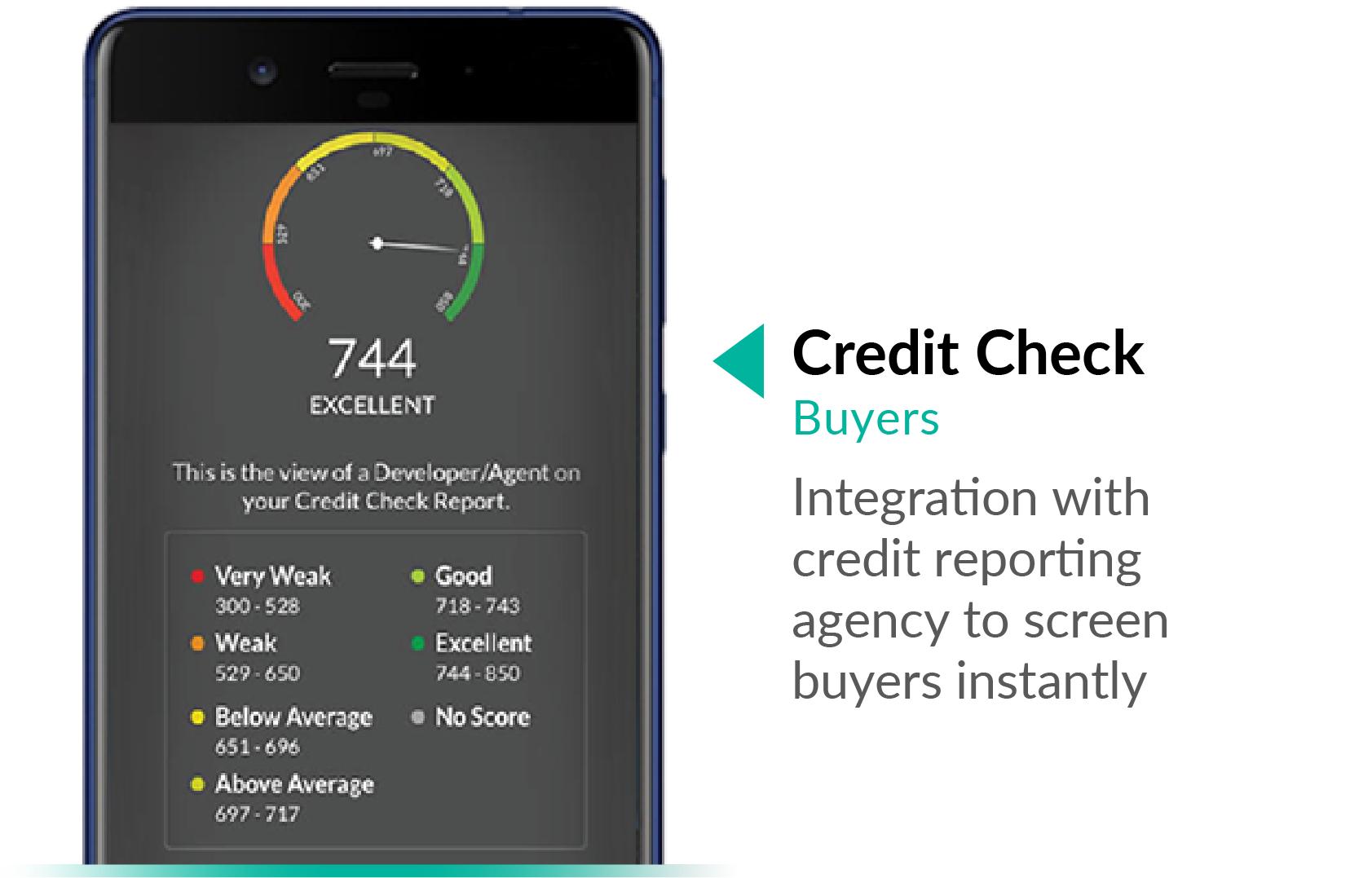

While booking can be done immediately by paying a booking fee, it takes awhile before buyers know his or her loan eligibility – this translates to opportunity cost.

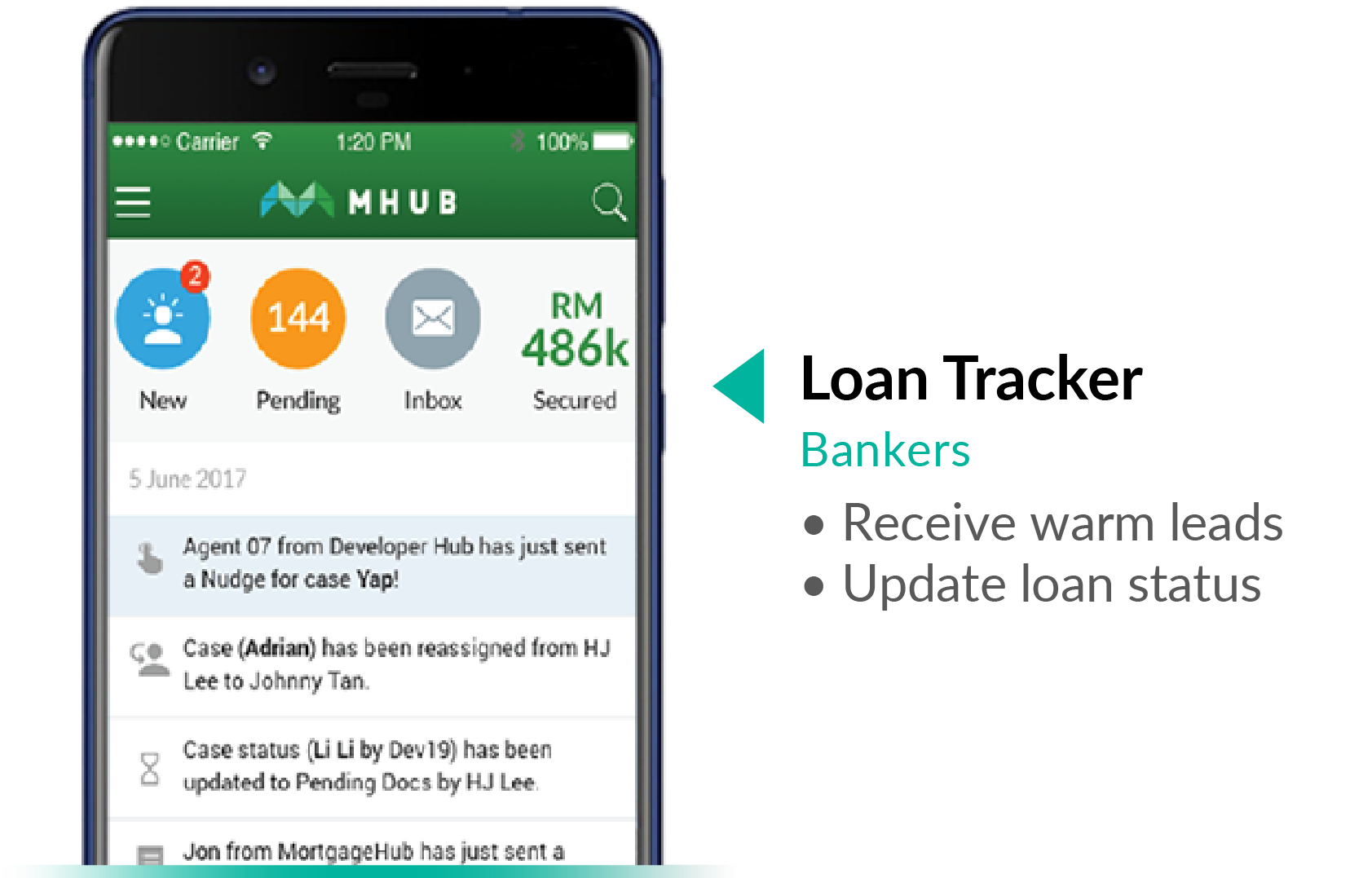

Once a booking is made, the loan application status of the buyers are unknown and it causes opportunity cost in sales especially if buyers are taking too long with their loan and not providing an updates.

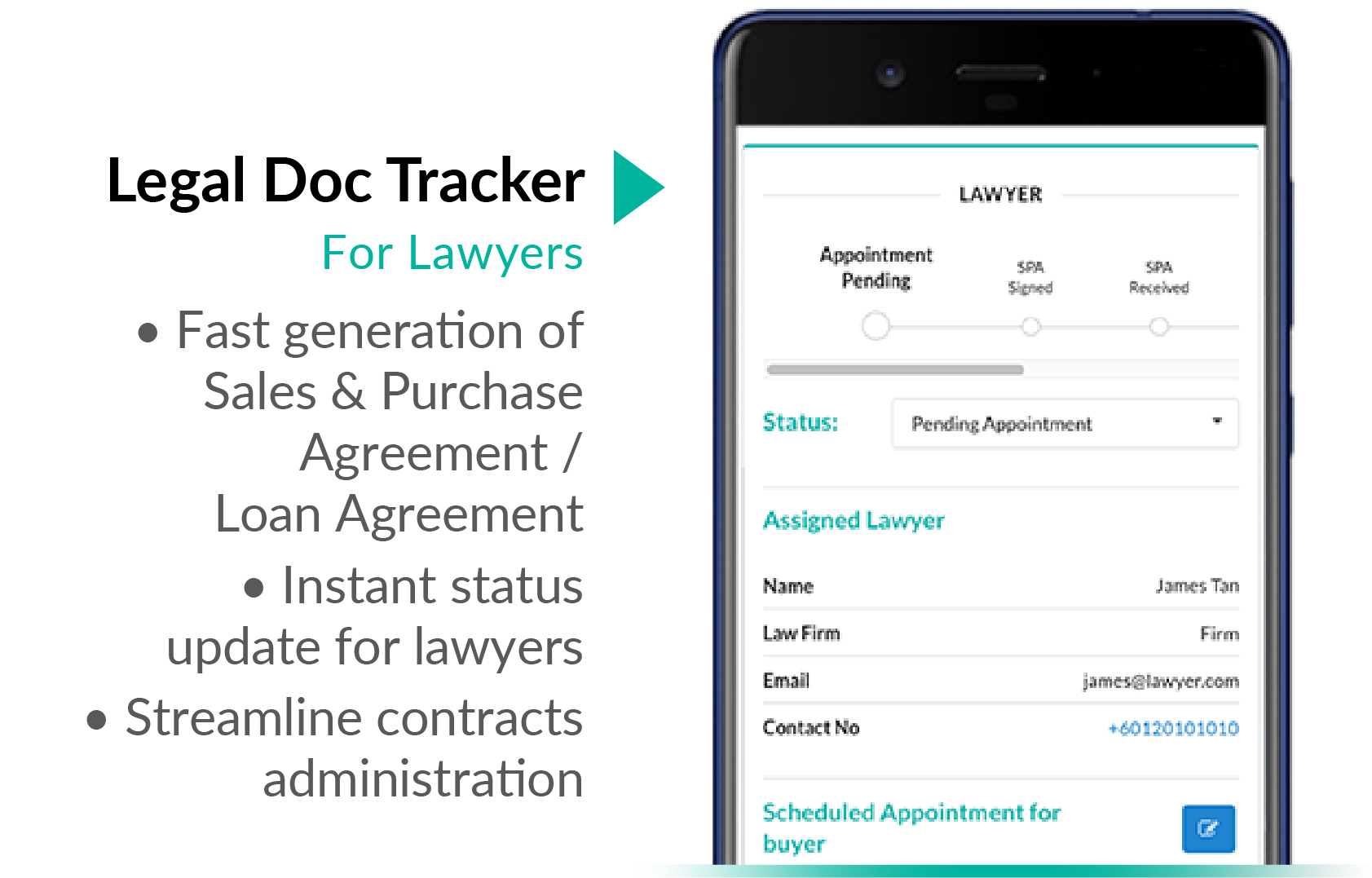

A necessary step to finalise a deal, appointment for signing, contracts administration are often time consuming and the lack a proper flow means each law firm and developer doing it their way.

The solution is MHub; a platform that closes gaps in the property sales cycle. Unlike comparison sites, MHub is a platform that directly connects property sales teams, real estate agents, bankers and lawyers.